Turmoil extended across financial markets on Wednesday as significantly higher import taxes on goods entering the United States went into effect. The rout intensified as China ramped up its retaliation, saying it would impose an additional 50 percent tariff on U.S. imports, to match the Trump administration’s escalation.

Stocks fell but the tumult also hit government bond markets, in a somewhat counterintuitive turn that had investors and analysts speculating on what prompted it. Treasuries are traditionally seen as a safe haven in times of economic turmoil, because they offer investors a guaranteed payment backed by the U.S. government.

Instead, they’ve been falling. Yields on the 10-year Treasury note, which rise when investors are selling the assets, jumped to 4.47 percent on Wednesday, the highest since February.

Markets have been uprooted by President Trump’s announcement of across-the-board tariffs on most of the U.S.’s trading partners. Those took effect on Wednesday at midnight, with taxes on imports from China in exceeding 100 percent. Beijing has raised its own tariffs on the U.S. in tandem, and the additional 50 percent levy imposed on Wednesday would bring the total tariff on U.S. exports to China to 84 percent.

The European Union plans to vote on Wednesday afternoon on its first retaliation measures.

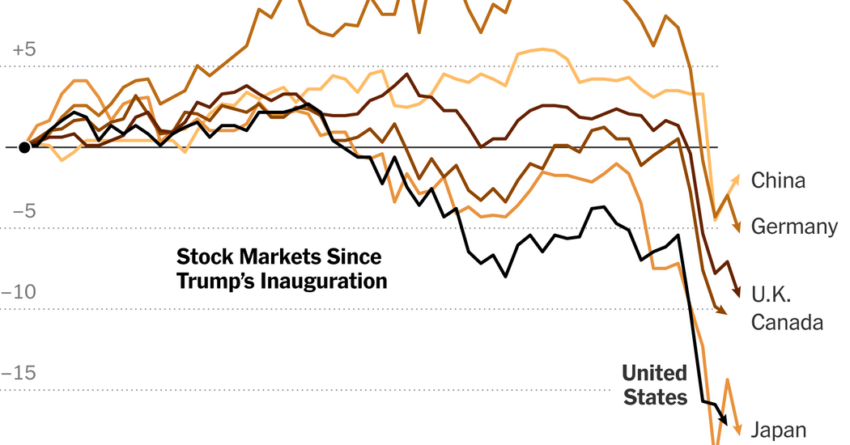

In the stock market, futures on the S&P 500, which let investors bet on the direction of the index when it resumes trading in New York, dropped about 1.8 percent. The index ended trading on Tuesday just above bear market territory, which is a 20 percent drop from a recent peak — a symbolic, and relatively rare and worrisome, threshold for investors.

Stocks in Asia mostly slumped: Taiwan was the worst hit, sinking more than 5 percent; benchmark indexes were down more than 3 percent in Japan and almost 2 percent in South Korea; and stocks listed in Shanghai gained slightly.

The Stoxx Europe 600 dropped more than 4 percent. The FTSE 100 in London fell more than 3 percent along with the benchmark indexes in Frankfurt, Paris and other European financial capitals.

An index of the U.S. dollar against other major currencies also slid on Wednesday, nearing its lowest level in six months, and oil prices tumbled.

“We are entering uncharted territory in the global financial system,” with simultaneous drops in the price of all U.S. assets, including stocks, the dollar and the bond market, George Saravelos, the global head of foreign exchange research at Deutsche Bank, wrote in a note. “It is very hard to foresee market dynamics in coming days.”

Analysts at Rabobank, a financial firm in the Netherlands, noted that markets were in a “strange situation”: Treasury yields are climbing while bets were increasing on how many times the Federal Reserve would cut interest rates. They cited several possible reasons for the volatility in the bond market, including the wariness of investors to hold long-dated bonds when uncertainty is so high; or traders liquidating bond holdings to meet margin calls, when banks demand extra collateral to cover potential losses on assets bought with borrowed money. The yield on 30-year Treasury bonds jumped from 4.4 percent on Friday to 4.9 percent on Wednesday.

Analysts at Goldman Sachs said in a note late on Tuesday that recent sharp moves in Treasuries and other markets “suggest a higher risk that market function may be deteriorating there.”

Economies in Asia will be hit hardest by Mr. Trump’s tariff increases, according to analysts at BMI, a unit of the research firm Fitch Solutions. While they are waiting “a few days” to see whether countries can negotiate tariffs down, when it comes to forecasts of growth, there are likely “large downward revisions in order,” they said.

Administration officials appeared to leave the door open for negotiations that could ultimately defuse the trade war, citing the fact that dozens of countries had approached the U.S. government in recent days to strike deals.

But White House officials have sought to set a high bar for what the president is willing to accept, marking a shift in tone after Mr. Trump and his aides initially signaled they would not haggle over tariffs at all.

Treasury Secretary Scott Bessent signaled the United States isn’t planning to back down after China retaliated again against President Trump’s tariffs. “They are the surplus country,” he said on Fox Business on Wednesday. “Their exports to the U.S. are five times our exports to China. So, they can raise their tariff, but so what?”

Earlier this week, Japan emerged as the first major economy to secure priority tariff negotiations with the Trump administration. The news triggered a brief surge in Tokyo-listed stocks before they resumed their decline on Wednesday.